VCs are at the forefront of technological disruption, funding many of the latest cutting edge productivity tools. But what tools are most commonly in VC’s Tech Stack to help them automate their own processes?

As a globally focussed LP in early stage VC funds, we at Blue Future Partners have observed a growing trend of firms investing substantially in software tools, whether developing proprietary solutions or adopting off the shelf tools. These GPs believe strongly that automating data gathering, sifting through and selecting investment opportunities, managing relationships and streamlining follow-on funding and exit processes, gives them a competitive advantage over their peers.

In his white paper How Private Equity and Venture Capital Investors Are Eating Their Own Dogfood, PEVCTECH.com founder David Teten explored how private equity and venture capital investors are trying to automate more of their job. Based on this paper, Blue Future Partners and PEVCTechrecently completed a large-scale survey to find out which tools are most commonly used by venture capital firms.

Lisa Edgar, Managing Director at fund of funds Top Tier Capital Partners, observed: “It’s not surprising that venture capitalists are using software to help manage their business. The VC landscape has gotten much more competitive and crowded over the past several years, and if investors are not using software tools — they are definitely at a disadvantage. In addition to off-the-shelf products, many VCs talk about their own proprietary systems. These take considerable time to design, build and populate, and require regular use and “feeding of the beast”, as we call it. However, all of the current talk about machine learning and AI tools running on top of these databases is absolutely nonsensical, unless there is keen focus and incentives on getting the underlying data right. At Top Tier, we have been continuously refining our database and analytics engine, and we use it and other software mentioned in this article to make better decisions, spot trends, and stay in front of targeted venture capitalists and entrepreneurs. As a result, we truly relate to VCs that are using software to make them better investors and stay ahead of the pack.”

Clint Korver, Partner at Ulu Ventures, remarked: “I’d compare this technology transformation as akin to what happened in public company investing. 20 years ago, much of public equity investing was done by mutual funds run by a few smart folks picking stocks. The industry is now dominated by hedge funds and other quant driven approaches. It’s hard to find anyone who says “I just have the magic” in stock picking. I’d expect a similar shift in venture over the next decade or two.”

645 Ventures, a New York City based VC firm, is one of the pioneers of a data-driven investment model to the seed stage. Nnamdi Okike, a former Principal at Insight Venture Partners and co-founder of 645 Ventures, describes his firm’s model as “a combination of an outbound deal sourcing strategy leveraging software and automation to help the team identify high-potential, rapidly growing companies. We use technology to enhance every stage of the early-stage investment process, from sourcing to evaluation to value-add.”

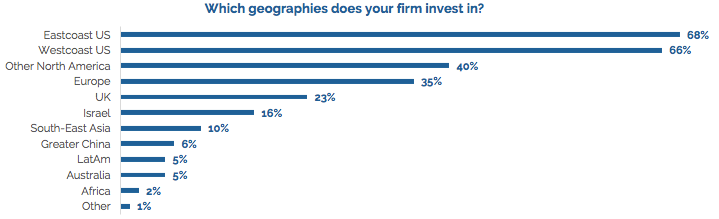

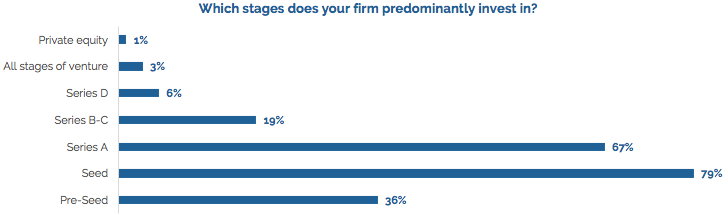

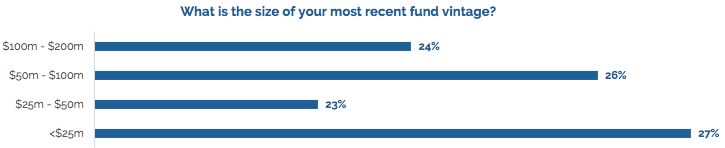

Below is a summary of the most important findings of our tech stack survey, based on 137 responses from largely smaller VC funds (<$200m in fund size). The full survey results are available exclusively to respondents of the survey.

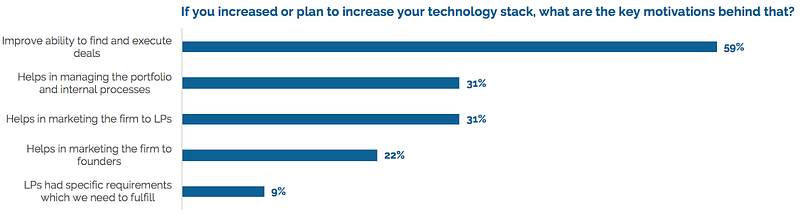

First, we asked VCs about their motivations for improving their VC’s tech stack (multiple replies were possible in all questions):

VC’s Tech Stack: What tools do VCs use to market their fund?

In times where arguably too much money is around in the venture capital industry, and therefore fierce competition exists for the best deals, many VC firms work hard to build their brand to attract founders and “make it onto the list”.

Creating content and sending it out via newsletters has been one of the most popular ways for VC funds to market themselves. In our survey we asked VCs which tools they use to market their funds via newsletter: MailChimp was the clear winner, used by some 49% of respondents. Some 33% do not use any newsletters.

We also asked what tools VCs use to create and spread their proprietary content for marketing and brand-building purposes. 73% responded that they did not use any tools for this purpose. 8% replied that they used Medium.

Which solutions do VCs use to streamline the process of raising capital?

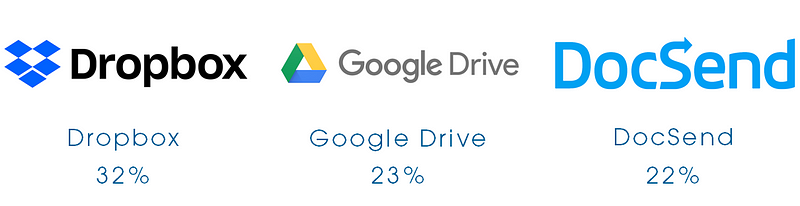

When raising funds and sharing information with potential LPs, most firms we’ve surveyed rely on generalist tools: Dropbox, DocSend, and Google Drive followed by Box. Some respondents use specialist virtual data room providers; Intralinks or SecureDocs were used by 8% of respondents.

While the historic capital-raising process is driven by face-to-face networking and salesmanship, some GPs actively participate in LP/GP communities to find and build relationships with potential LPs. Palico (7%) and Trusted Insights (6%) are the firms mentioned most often in our survey. However, 87% of our respondents don’t actively participate in any such community. We believe that these services generally suffer from a “cold start” problem.

If LPs were actively trawling through these services looking for VCs, the VCs would show up. However, we have not heard from any VCs yet who have won capital from a cold outreach on these platforms. VC is a niche asset class, so we suspect that more popular asset classes will get more capital-raising benefit from such platforms.

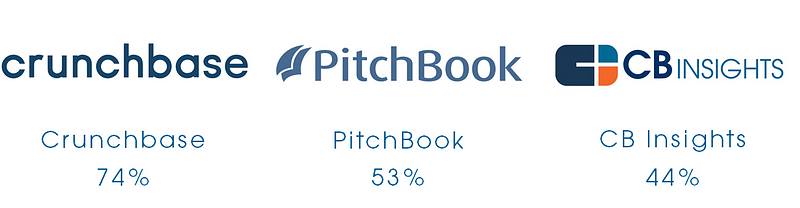

Keeping their records updated with the VC industry’s major data-trackers helps firms to market themselves to LPs. A majority of respondents regularly update their data on Crunchbase and Pitchbook. CB Insights, Preqin and Mattermark were also named as platforms that are regularly updated by GPs.

VC’s Tech Stack: How do VCs originate investments?

For both deal origination and due diligence, a host of companies aspire to be the “Bloomberg of private companies”. To originate deals, most VC firms rely on some of the more obvious data providers, such as Crunchbase, CB Insights and Pitchbook. Mattermark and Tracxn were mentioned by 24% and 17% of respondents respectively.

Taking a step further, some funds build their own tools to extract data from those platforms to try and identify high-potential companies. One of the most recent examples is CircleUp, which recently announced a new quantitative fund to invest in consumer packaged goods companies. Their proprietary software, Helio, incorporates machine learning as the key component to find and pinpoint investment opportunities more objectively and efficiently.

Mamoon Ismail Khalid, Venture Associate at Quake Capital Partners in New York City, describes their deal sourcing approach as follows: “We use a new Web Interface to collect information from our applicants in a standardized manner. The goal is to intelligently structure the information collected and combine it with additional information scraped from the web and social media. We store it in a logically indexed manner and apply Predictive Analytics on companies’ metadata. Our proprietary data science tool cumulatively looks at 100+ factors within 6 macroscopic categories: Team, Financial Performance, Customer and PR traction, Industry and Competition, Product and Brand value, Valuation, and Exit probability, to quantify an investment “Merit Score”. We are taking a mathematical (weighted coefficients estimation, probabilistic modelling, etc), human-system hybrid approach to early stage investing through this tool. We believe this way we can extrapolate insights for our particular business model (portfolio operator VC fund) previously missed out.”

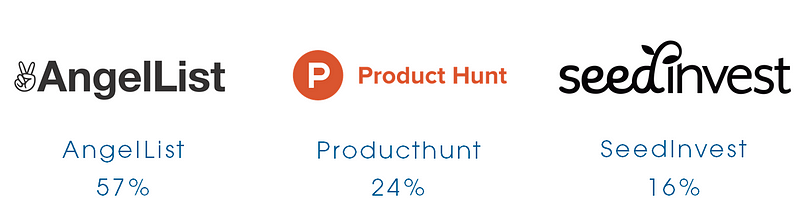

Some early stage investors mine data from crowdfunding sites, angel group platforms, and product launch lists to identify investment opportunities.

AngelList is by far the most popular platform amongst respondents, whilst some 39% of funds replied that they don’t review any of those platforms for deal leads on a regular basis.

Gary Benitt, Managing Partner at SocialLeverage, explains how they actively leverage AngelList, ProductHunt and other crowdfunding sites: “It’s less about finding new deals that we might want to invest in, and more about getting a pulse for what types of companies and products seem to be launching, generating traction, etc. There are times when we might be interested in a company, but because we keep an eye on sites like AngelList, we might recognize that in the past 6 months, we’ve seen 4 or 5 similar companies and can really hone in on why we think this company might be more successful than the others — or not.”

VC’s Tech Stack: What tools do VCs most use to manage their deal flow and internal processes?

To manage their own workflow, VC firms use a variety of project management tools, with Slack, Trello and Asana being the most frequently mentioned ones.

Ramanan Raghavendran, Managing Partner at Amasia, explains how they’re managing their processes: “At Amasia, our distributed presence on both sides of the Pacific mandates the use of technology to be effective, timely and coordinated. We make heavy use of Slack both internally and with our portfolio company founders for messaging and task progression. We’ve tried just about everything for team task management from Asana to Trello to Wunderlist to Dapulse; our current favorite is Airtable, whose flexibility allows for a variety of standing and ad hoc task lists. We’re currently testing Zapier to pull tasks together from Slack, Pipedrive (our CRM) and Airtable into a single interface. We’ll never stop tinkering with our tech infrastructure; just the act of trying out new tools often helps us streamline an inefficient process.”

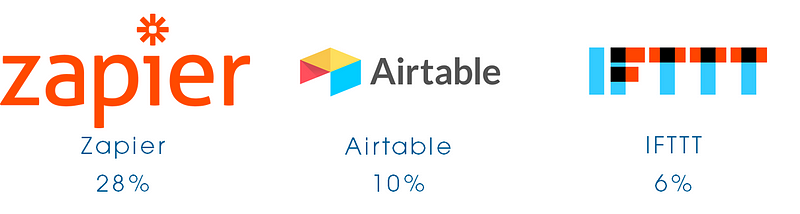

Numerous other VC firms use tools to help the different parts of their tech stack work together: Zapier, Airtable and IFTTT made the top three in our survey. Another important use case for such tools is the organisation of unstructured and structured data throughout a VC firm’s workflow, as Eliot Durbin, Partner at Boldstart Ventures confirms. Boldstart uses both Zapier and Catalytic for this purpose.

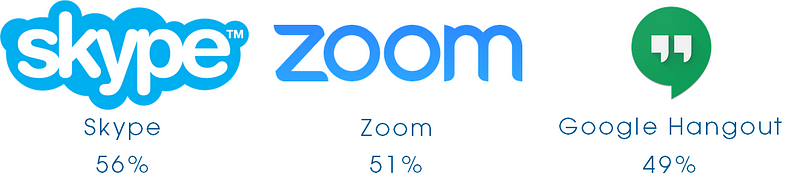

In the relationship driven world of Venture Capital, managers rely heavily on communication in their jobs, and therefore require reliable communication tools.

By far the most commonly used services are Skype, Zoom and Google Hangout.

When a new deal is added to Quake Capital’s system, they automatically set up a folder in Google Drive with all docs and info they have and schedule an internal Google Hangout to discuss the deal. If the reviewed company is marked as interesting, they’ll use Google Meet, Google Calendar and Calendly trio to schedule a video call with the founding team. All the info they’ve collected from the company and external sources is automatically summarized with Python and Matlab integrations in an Excel sheet, which they’ll share with founders before the call and ask for missing data points.

Whilst there are numerous custom solutions for PE/VC funds, we found that most funds nonetheless rely on more generalist CRM and sales funnel solutions like SalesforceIQ, Streak and Pipedrive.

Sevanta Dealflow is the most used CRM-system dedicated specifically to VC/PE, however, only 4% or respondents reported using it. One of the reasons may be that generalist CRM tools tend to have much more reliable support resources. VCs more than anyone else are fully aware of the risk of putting critical infrastructure onto the back of an early-stage startup.

Thomas Wilke, Managing Partner at 42CAP gives the following reasons for using Streak: “It is a very flexible CRM tool that allowed us to manage our deal flow and fundraising right out of the inbox. The flexibility of Streak to adapt to a general set of processes was a major plus compared to specialized solutions. It would be helpful if next generation CRM systems would add a more comprehensive and intelligent tracking of public available information of people and companies.”

5% of our respondents reported that they are building their own proprietary CRM system.

Semil Shah, General Partner at Haystack Fund, observed that “to be successful in sourcing companies and winning deals, (larger) VC firms need to invest the time and money to build their own CRMs and databases, as existing solutions don’t do it.”

Despite the large number of utilities that one might find helpful to complement one’s CRM system (e.g.with external data sources), such as FullContact or Clearbit, most VC firms (52%) we asked do not use any tools in this regard.

VC’s Tech Stack: We were keen to understand what resources VCs use to support their due diligence effort?

Most VCs we surveyed use Gartner’s research to quantify consumer trends and market opportunities. For “top down” analysis of broader trends, our respondents like to resort to tools such as eMarketer and IBIS World. For bottom-up exercises, Statista and the United States Census Bureau are frequently used resources.

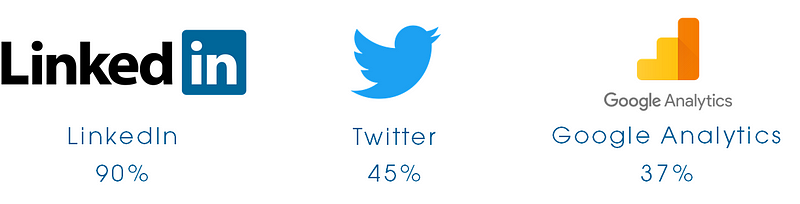

The most frequently used channel to research people is unsurprisingly Linkedin, followed by Twitter.

To measure product usage and traction over time, most VCs use Google Analytics, AppAnnie and Alexa.

What has been helpful to funds to manage their deal negotiation processes?

Insight into a negotiating partner’s social media activities and digital exhaust to inform negotiation tactics can be helpful during deal negotiations. Some investors mentioned Accompany to be a useful tool for this purpose. The vast majority of 93%, however, do not use any tool for this, and presumably follow their instincts.

For the purpose of generating and executing a contract, a large number of respondents use DocuSign, with a few using HelloSign and SRS Acquiomwhich help manage documents, payments, etc.

VC’s Tech Stack: How do funds use tech to monitor and report investments?

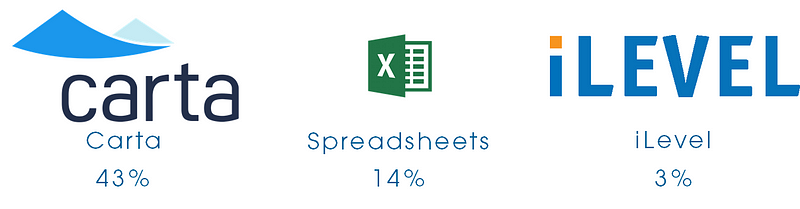

As limited partners, we at Blue Future Partners are keen to understand on an ongoing basis how each underlying company in our portfolio funds is performing. We understand that from a GP perspective, pulling data from different sources, aggregating and standardising them is one of the biggest pain points in their reporting process. Amongst the software tools used to streamline their reporting process, Carta is the most popular tool for tracking private company cap tables. Some firms use iLevel or Qualtrics to assist reporting requirements.

VC’s Tech Stack: How can accelerating portfolio company value be aided by use of software?

A big part of the job for VCs is to accelerate value creation for their portfolio companies. We asked which tools they find particularly helpful to improve processes like board management, recruitment, sales and financial management.

To manage board meetings, our respondents mentioned a variety of data sharing tools like Box (12%), Dropbox and Google Drive (6% each). For recruitment and sales, LinkedIn is the most commonly used resource. 61% of respondents use it for recruitment and 41% for identifying potential customers. Several others like Workable, Slack, and Angellist are used to find, research and contact candidates.

Tytus Michalski, Managing Partner of Fresco Capital, explains their approach to portfolio acceleration as a global VC with a team based across multiple continents: “The tech stack is a core part of helping our portfolio companies. First, to ensure a team based approach, communication and support activities are logged in Pipedrive and updated to Slack in real-time. Second, for new market entry, we create custom content about portfolio companies in Medium and MailChimp, and then use a mix of LinkedIn, Facebook, WeChat, LeadIQ, and Pipedrive to identify both local partners and potential customers for portfolio companies. Third, talent recruitment is supported by the use of LinkedIn, AngelList, and Glints. Most importantly, we’re always looking for new tools which could improve our ability to support portfolio companies and even become potential investments because the future of work is one of our core areas of investment focus.”

How can the timing, marketing and exit process be supported with software?

It turns out there remains a lot of upside for the use of software and online resources to identify potential buyers or facilitating the M&A process.

Whilst some VCs mentioned that they use MergerMarket (3%) or Axial (2%), a whopping 74% indicated that they do not use any such resources to manage their exit process. The same appears to be true for the early liquidation of positions in companies, even before a sale. While SharesPost and EquityZen(both 2%) have been mentioned, our survey results show that a grand total of 93% don’t rely on any tools for this process.

Finally, we were interested in what VCs were planning going forward to improve their tech stack?

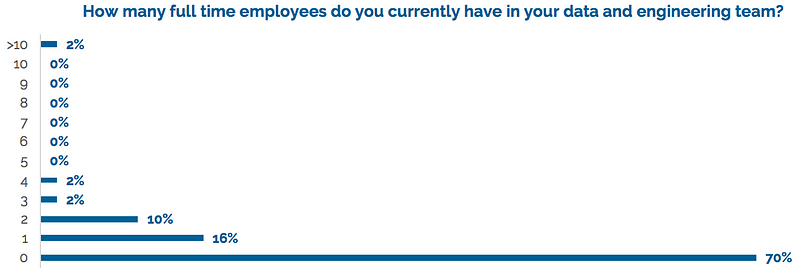

It looks like GPs are spending money to solve the pain point in their processes: Some 30% have a full time resource dedicated to data and engineering.

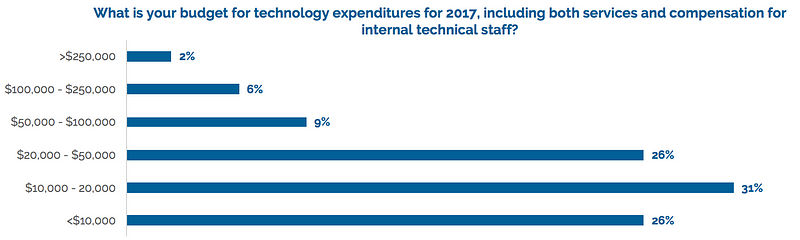

It would appear that most of our respondents are spending quite a bit of money on their technology (bearing in mind these are mostly smaller firms) with 74% having spent $10k or more in 2017. Some 17% have spent in excess of $50k in the same year.

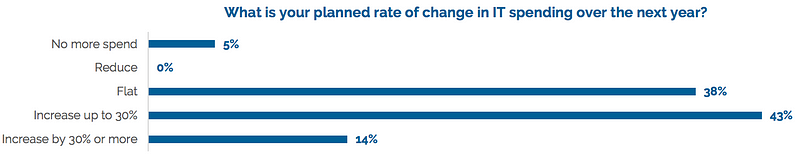

What’s more, the majority of respondents said that they plan to increase their VC’s Tech Stack budget in the coming year. Some 14% plan to increase their spend by 30% or more.

Kjartan Rist, Managing Partner at the UK-based VC firm Concentric, explains some of the difficulties faced by emerging managers in building their own tech stack: “Many VC funds are young organisations with relatively small budgets, and team members who are spinning a number of plates at the same time such as fundraising, deal selection and portfolio management. Furthermore, VC firms tend to adopt a variety of tools from portfolio companies to be able to facilitate a dialogue with them. This often causes a ‘hotch-pot’ of different tools being utilised, while some are more dynamic than others. VC firms are often only able to use more sophisticated software and to build proprietary IT platforms when they are more mature as a firm.”

So it appears there is a lot more to happen as Venture Capitalists are starting to “eat their own dog food”. We look forward to seeing how this evolves further.

VC’s Tech Stack: Methodology

This report summarizes our findings from a survey of venture capital firms focussed on early stage investing. The portrayed statistics are derived from 137 responses to the survey. All data has been cleaned. Respondents who completed the entire survey in less than 2 minutes or were not identifiable by name or e-mail have been removed, as were multiple answers from professionals from the same VC firm. For the purpose of this report we have only included responses coming from fund managers with individual fund sizes of US$ 200m and less. The statistics have been complemented with circumstantial observations and quotes from some of the more technologically advanced firms to provide further colour. With this report we hope to promote best practice amongst both VC firms and LPs.

The survey fielded from August 10th to September 28th. The anonymized, long form results of the survey have been shared with all participants in the survey.

Respondents

Authors:

Philipp von dem Knesebeck, Managing Partner, Blue Future Partners (bluefp.com, @bluefutureteam)

And

David Teten, Founder of PEVCTECH.com (teten.com, @dteten) and Managing Partner, HOF Capital (HOF.capital, @HOFCapital)