What type of partnership models are there?

Most newly established VC funds start out as either single GP firms or a partnership of two. If there are two founding partners at the outset, the split of economics and carry tend to be equally distributed.

We have seen exceptions, however, where one of the partners brings significantly more investing experience, or an anchor LP-relationship to the table. In rare examples, carry distribution between partners is tied to the performance of the individual deals they lead.

…and how do they evolve as they grow?

As VC firms become more established and add further partners, the question how economics are shared with new additions arises. Founding partners often expect to retain a larger share of the pie given they started the firm. New partners are also frequently expected to earn their seat at the table.

The model we most frequently see has new partners starting out with a partial carry on the first fund vintage they join, and then graduating to their full share of the carry on the second. E.g. with an eventual carry participation of 5 points (out of 20) the new partner might start off with 2.5 points in the first vintage she joins, and then receive the full 5 points only on the subsequent fund.

BFP’s take on Partnership economics

From a Limited Partner’s point of view, partnership stability is one of the biggest risks when investing in funds. If the partnership falls apart, this can adversely affect investment performance and follow-on fundraising success. Even the LPs’ overall relationship with the VC firm, which is frequently anchored around individual partners, can deteriorate as a result.

Amongst VC managers we have observed, equal partnership firms have been more stable than unequal partnerships. This is not surprising given insufficient economic incentives are often a reason for partners to leave a firm.

Just for that reason at Blue Future Partners we prefer equal partnership structures.

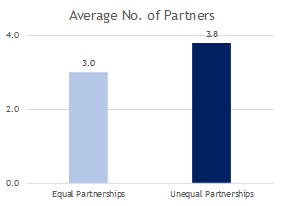

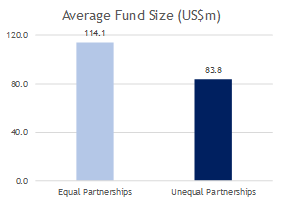

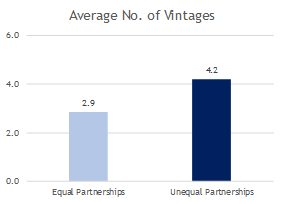

Observations from BFP’s VC fund portfolio

Below are a few stats derived from our own portfolio of currently 15 active relationships1 with Emerging Managers2:

1 The actual sample size is 12, as we have removed two single-GP partnerships, and one outlier with a very large number of partners relative to their fund size.

2 Which in our case are Early Stage VC funds with individual fund sizes below US$ 200 million.